SBA Business Plan Services

We welcome clients seeking SBA 7(A) Loans, SBA Express Loan Programs, SBA CDC/504 Loan Programs,

Real Estate Loans, SBA Disaster Loans, and SBA Exporting Loans

Help us help you secure SBA-backed bank financing for your small business.

Please answer the following questions to assess your initial eligibility for startup business loans:

What phase is your business in?

Question 1 / 2

SBA Business Plan OVERVIEW

SBA BUSINESS PLAN

SBA loans are designed to assist a wide range of entities, including small business owners, startups, existing businesses, veterans, minorities, women-owned businesses, and those affected by disasters.

10 TIPS

on getting your SBA Loan Approved

OUR WORK

VIEW A SAMPLE SBA BUSINESS PLAN

SELECT A CATEGORY

Investor Business Plans

Market Research Reports

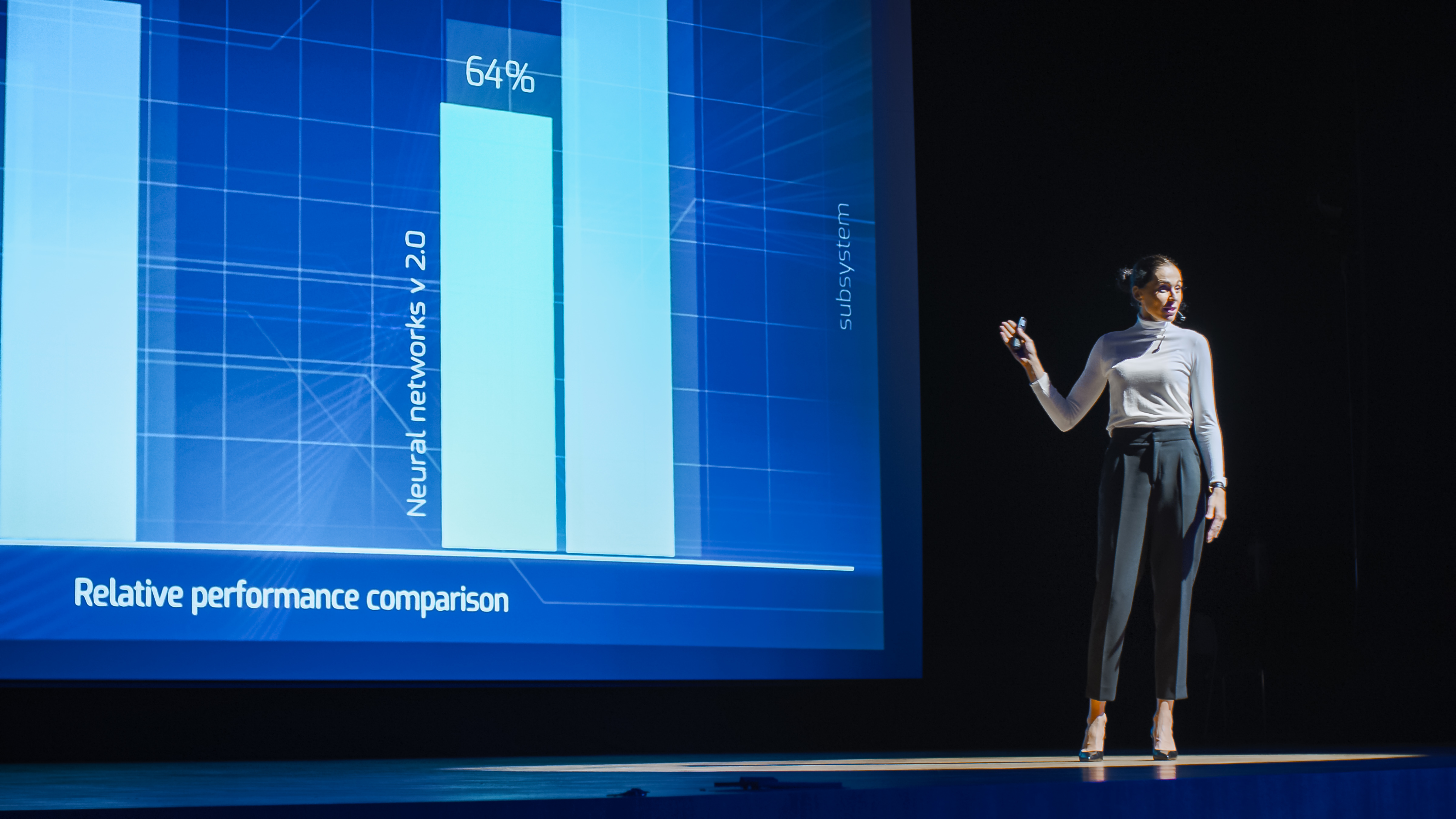

Investor Pitch Decks

PPM Plans

WHY VENTURE PLANS?

Seasoned

With decades of cumulative experience, we are uniquely qualified across a range of industries.

Accredited

Ivy-league trained management consultants, seasoned legal consultants, certified valuators and analysts.

Data-driven Analytics

Insights and recommendations based on qualitative and quantitative metric.

Trusted

By top Fortune 500 CEO's nationally and globally.

%20(1).jpg)

FEATURED SERVICES

- Business Strategy

- Legal Advisory

- Financing

- Technology

- Internship & Externship

- Invest in Private Equity

- Investor Relations Software (AI)

- Industry Market Reports

Let us help you secure a small business capital loan.

Apply to SBA small business loans with a custom SBA business plan.

Book a ConsultationAS FEATURED IN

TELL US MORE ABOUT YOUR PROJECT

- 15+ Years in Operation

- 4750+ Projects done

- 3 Offices

- $650 M Capital Raised

Accredited

FINRA, CFI Institute, Harvard, Certified Valuators and Analysts.

Completed Applications in 3 Days.

Expedited

As seen on

OUR CLIENT’S WORDS

See how we have helped our clients secure funding with an SBA loan, an American Express small business loan and other lenders from small business loans.

Secure funding with an SBA business plan.

SBA BUSINESS PLAN PROCESS

Secure small business loan funding with a world-class business plan.

Check SBA 7(a) requirements for Business Fit

Gather Business Information

Interviewing The Founder

Structure & Outline The First Draft

Financial Projections & Historic Financial Analysis

Review & Revise

Need a SBA Business Plan?

YOUR ONE CLICK AWAY FROM GETTING YOUR BUSINESS LOAN!

Click the buy a service button to book an appointment with us.

OUR TEAM

Ensure long-term business success with business expansion loans.

Arleo Dordar

Founder & President

Arleo Dordar is the Founder/CEO, investor, and product architect of Ventureplans™. Arleo is a visionary with a strong leadership background. He has assisted various Fortune 500 companies in scaling, restructuring, organizing, and developing sustainability plans for 4500+ businesses across 150 industries globally, resulting over $100 million dollars in investments. Arleo's expertise is in the implementation of revenue growth, execution, financing and digital transformation. Arleo engages in high-level discussions with startups, small businesses, and enterprise level organizations to gather and analyze big data, understand trends, and proactively deliver insights, recommendations, and drive improvements based on qualitative and quantitative metrics in to enhance operational efficiency, sales, marketing, and branding to achieve financing goals. Arleo is fluent in English and Farsi.

Amaris Olguin

Senior Business Analyst & Lawyer

Harvard and Yale Alumna, Fulbright Scholar, Fluent Spanish speaker, Proficient in Mandarin and in Hindi. Amaris has 8+ years of business experience. She brings deep expertise in business consulting, strategic planning and financial forecasting. As a lawyer, her primary focus is corporate law. Amaris works closely with clients on the development and execution of business strategy. She specializes in writing business plans that have resulted in large investment accomplishments.

John Varley

Corporate Legal Counsel

John Varley is admitted to practice law in California, Including the California Supreme Court, Ninth Circuit Court of Appeals, United States Tax Court, and the US District Courts- Southern, Central, Eastern and Northern Districts of California. In the area of Corporate and Bankruptcy Law, John has personally filed more 2,500 successful cases through the Federal Bankruptcy Court System. John is one of the few attorneys to have trained and certified in the three separate training trips to North Carolina under the preeminent bankruptcy litigator, Oliver Max Gardner. He received his Juris Doctor from Thomas Jefferson School Of Law In 2007. John Varley is a Certified Public Accountant (Delaware) and earned an MBA with emphasis In Finance from San Diego State University In 1989. He received his Bachelor of Arts Degree In Economics from UCLA In 1984. He is a member of Mensa High IQ Society.

FAQS

Do you have any questions about the SBA business plan writing process or bank requirements?

What are top small business loans that I can apply to with an SBA business plan?

What are the eligibility requirements for a business to apply for an SBA loan?

What are the different types of SBA Loans that I can apply to?

Can start-ups get an SBA gov loan?

What are the requirements for an SBA Express and 504 Loan?

How can I apply for an sba disaster loan with an sba business plan?

What are top sba lenders that require sba business plans?